Loan depreciation schedule

Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. Order a BMT Tax Depreciation Schedule BMT has completed more than 800000 property depreciation schedules helping Australian taxpayers just like you save thousands of dollars every year.

Mortgage Amortization Schedule Online 60 Off Www Wtashows Com

What does a depreciation schedule include.

. The payment amounts are generated by an amortization calculator. We use named ranges for. It also refers to the spreading out.

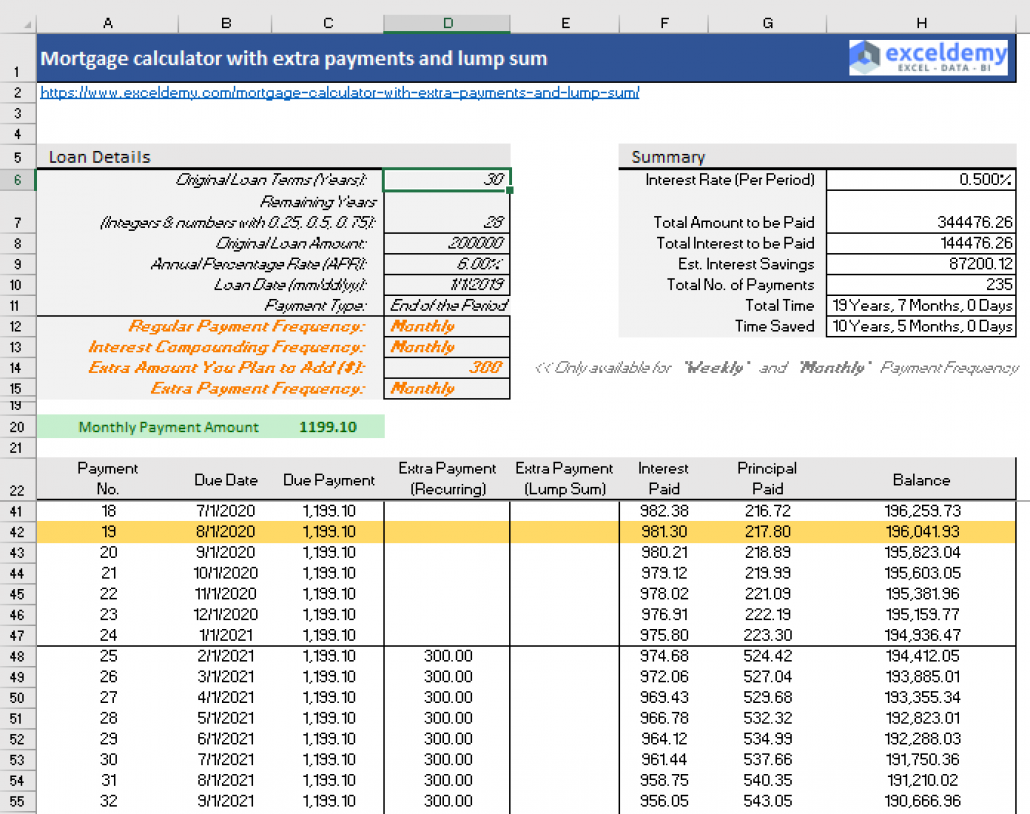

We still have 167772 - 1000 see first picture bottom half to depreciate. Allows for 1 or 2 mortgages. Call our expert team today on 1300 728 726 or complete the form below to find out how we can help you maximise the deductions from your investment property.

We do not recommend sponsored lenders or loan products and we cannot introduce you to sponsored lenders. Rental Income and Expenses If No Personal Use of Dwelling. It is not your tax refund.

Creates a printable cash flow schedule. Depreciation Throughout Loan. Although the uses of a depreciation schedule can vary from company to company as each business uses this schedule for their own purposes there are still some common scenarios to apply this schedule.

Calculate the monthly payments total interest and the amount of the balloon payment for a simple loan using this Excel spreadsheet template. Chapter 2 discusses depreciation as it applies to your rental real estate activitywhat property can be depreciated and how much it can be depreciated. Paying Off a Loan Over Time.

In lending amortization is the distribution of loan repayments into multiple cash flow instalments as determined by an amortization scheduleUnlike other repayment models each repayment installment consists of both principal and interest and sometimes fees if they are not paid at origination or closingAmortization is chiefly used in loan repayments a. For the depreciation schedule for computers and computer equipment depreciation you may claim a deduction under Section 179. Categorize and Organize the Loans Effectively.

Depreciation Value Straight Line is higher so we switch to Straight Line calculation. While only properties built after July 1985 qualify for both types of deductions you can still claim plant and equipment depreciation on properties built before this date. And charges connected to getting or refinancing a loan including points mortgage insurance premiums credit report.

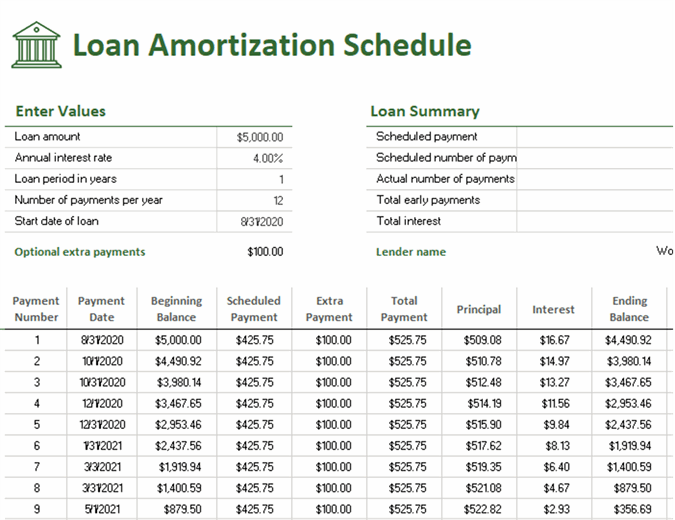

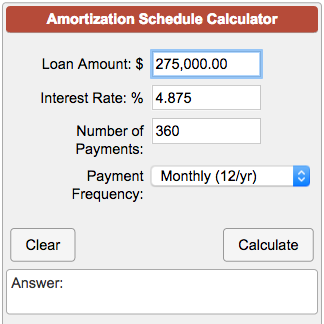

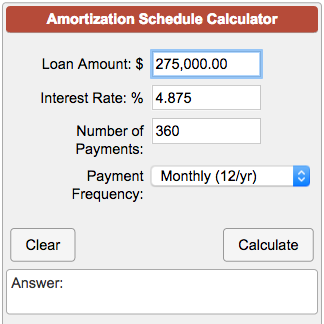

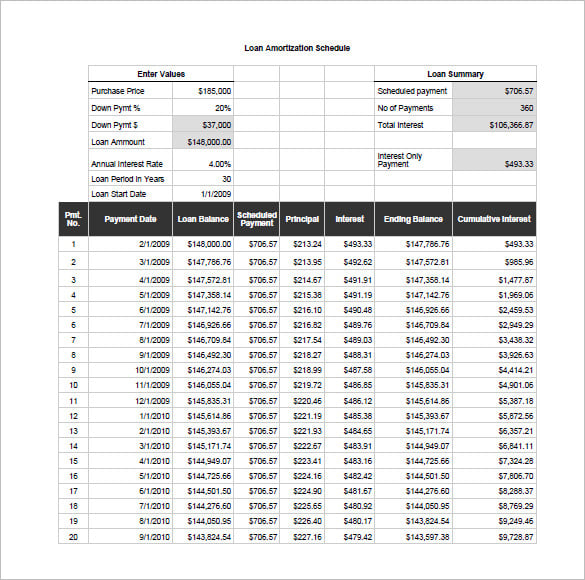

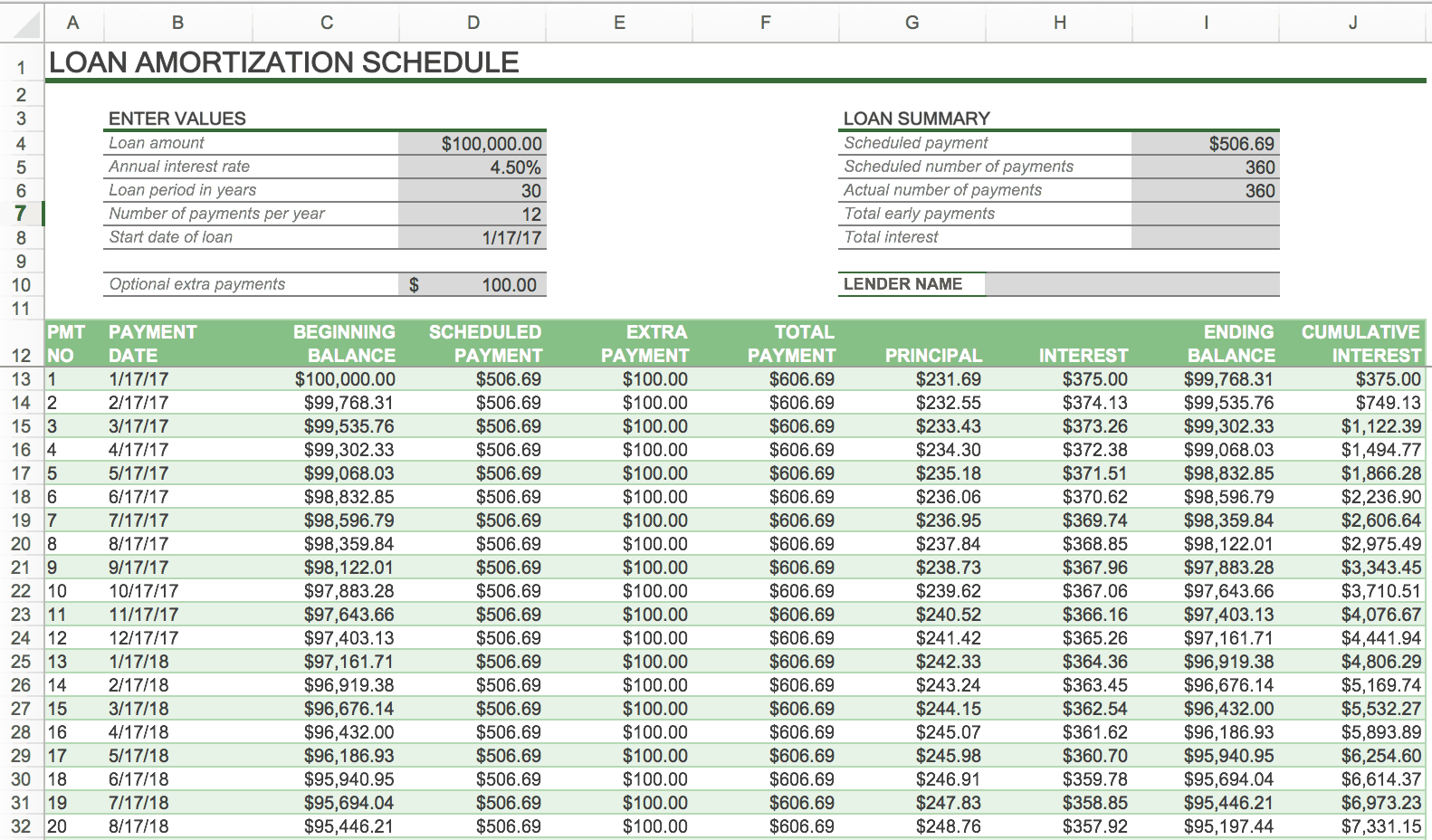

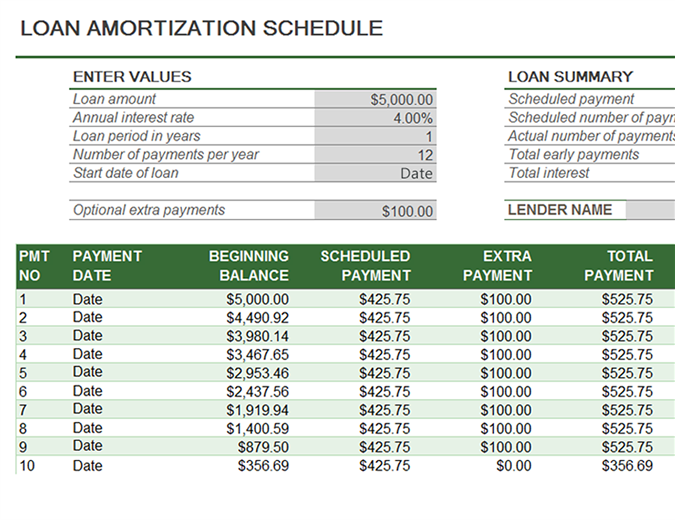

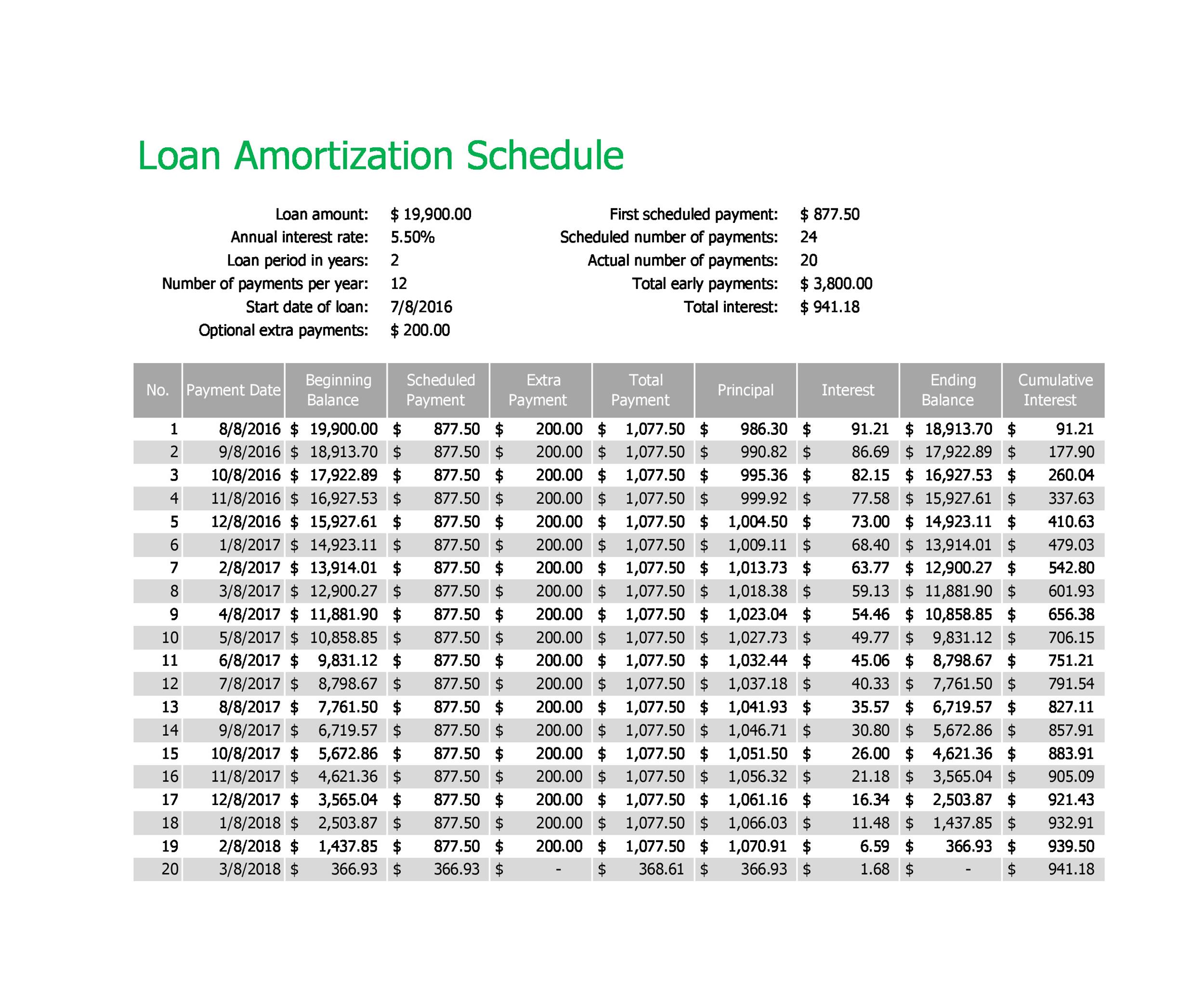

Lines 23a26 should be filled in for only one Schedule E by combining totals from your other. Here is an example amortization schedule for a loan with the following characteristics. Amortization Schedule showprint schedule.

His depreciation deduction for each year is computed in the following table. In the AssetsDepreciation section elect to EDIT this item. Real estate depreciation on rental property can lower your taxable income.

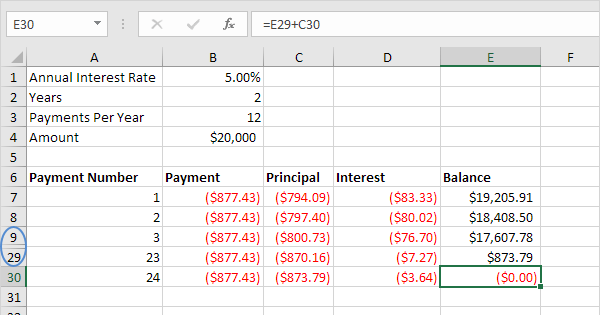

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. We use the PMT function to calculate the monthly payment on a loan with an annual interest rate of 5 a 2-year duration and a present value amount borrowed of 20000. Your depreciation schedule will take approximately 2-3 weeks to complete as long as the quantity surveyor can inspect your property without delay.

Considers taxes depreciation inflation and more. To be precise this table is the sum of principal amount and interest amount for the loan. I expect that IntangiblesOther Property is already selected by default.

Now heres how to do it correctly on a loan payoff not on a sale or refinance of the property assuming that it was initially entered correctly in the assetsdepreciation section of the SCH E. This is an optional tax refund-related loan from MetaBank NA. Net Purchase Expense sales tax interest depreciation - rebate.

If you have more than three rental properties use multiple Schedule Es. If we use Straight line method this results in 2 remaining depreciation values of 67772 2 33886. As the name determines in weekly loan schedule you have to.

Depreciation recapture is the USA Internal Revenue Service procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that had previously provided an offset to ordinary income for the taxpayer through depreciationIn other words because the IRS allows a taxpayer to deduct the depreciation of an asset from the taxpayers. Even for older properties the savings can be significant. You can even take a print of the template and fill it manually and then place it at a place which you access.

Loans are offered in amounts of 250 500 750 1250 or 3500. An amortization schedule is a table that lists all payments that will be made on a loan over time. A depreciation schedule is a detailed document that includes.

Schedule E has enough room for three rental properties. Furthermore the schedule is somewhat similar to the depreciation. When a borrower takes out a mortgage car loan or personal loan they usually make monthly payments to the lender.

The portion of the interest allocable to loan proceeds not related. Auto Loan supports optional trade in. In period 9 Depreciation Value DDB 33554.

Importance uses of Depreciation Schedule. Once depreciation for the year has been calculated it can be entered into Schedule E for the depreciation line item. Schedule E Form 1040 Supplemental Income and Loss.

We strongly recommend that you obtain independent advice before you act on the content. Year Cost x MACRS Depreciation Total 15000 MACRS Percentage Table Year 3 Year 5 Year 7 Year 1 3333 2000 1429. Sales Tax Interest Depreciation.

Creating an Amortization Table. These are some of the most common uses of amortization. Loan 3000 Services 1000 Total 6000 Return to top 10 What is class life.

For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400. Amortizing a loan means paying off the total balanceincluding both the interest and the principalin regular incremental amounts. The main download and the Google version now have.

This is why both of them have similar methods too. Car Value at End of Loan. This example teaches you how to create a loan amortization schedule in Excel.

Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation. Using the loan amortization schedule template excel you can plot your various loans with the respective amounts the payments due at various time intervals and you prepared plan for their repayment and track it daily. The spreadsheet includes an amortization and payment schedule suitable for car loans business loans and mortgage loans.

The only difference between them is of the loan. Free MACRS depreciation calculator with schedules. Assets are depreciated for their entire life allowing printing of past current and.

A part of the payment covers the interest due on the loan and the remainder of the payment goes toward reducing the principal amount owed. Below are common situations when its important to create a depreciation schedule. My article Amortization Calculation explains the basics of how loan amortization works and how an amortization table or schedule is createdYou can delve deep into the formulas used in my Loan Amortization Schedule template listed above but you may get lost because that template has a lot of features and the formulas can be complicated.

Adheres to IRS Pub. MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available.

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is Amortization Schedule

Amortization Vs Depreciation What S The Difference My Tax Hack

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Printable Amortization Schedule Templates Amortization Schedule Schedule Templates Schedule Template

Amortization Chart Template Create A Simple Amortization Chart

Loan Amortization Schedule Free For Excel

Loan Amortization Schedule Deals 57 Off Www Wtashows Com

How To Prepare Amortization Schedule In Excel With Pictures

Easy To Use Amortization Schedule Excel Template Monday Com Blog

Amortization Schedule Calculator

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

Loan Amortization Schedule Cheap Sale 53 Off Www Wtashows Com

Loan Amortization Schedule Deals 57 Off Www Wtashows Com

Loan Amortization Schedule Deals 57 Off Www Wtashows Com

Loan Amortization Calculator Sale 60 Off Www Wtashows Com

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Loan Amortization Schedule Deals 57 Off Www Wtashows Com